CSRD: A Reporting Directive Shaping Business Strategy

Introduction

Yes, this is yet another article on CSRD — but for good reason. If your company falls under its scope, you’ll need to submit your first sustainability report alongside your financial report for 2025, meaning the clock is already ticking. Given the complexity of the regulation and the scale of analysis required, now is the time to start preparing.

But there’s a silver lining: this sustainability disclosure isn’t just another regulatory checkbox exercise. It’s an opportunity — a structured framework to assess your business, uncover hidden opportunities and identify risks and even drive meaningful strategic and operational initiatives.

If any of this resonates, keep reading — or better yet, let’s talk.

What is CSRD?

“CSRD” stands for Corporate Sustainability Reporting Directive, which came into force at the beginning of 2023. Now, after two years, companies are preparing to publish their first sustainability statements alongside their financial reports.

CSRD replaces the Non-Financial Reporting Directive (NFRD), which previously applied only to large, listed companies with a limited reporting scope. CSRD was introduced as part of the European Green Deal to establish new sustainability reporting standards for both large and smaller companies operating in the EU market.

Who must report?

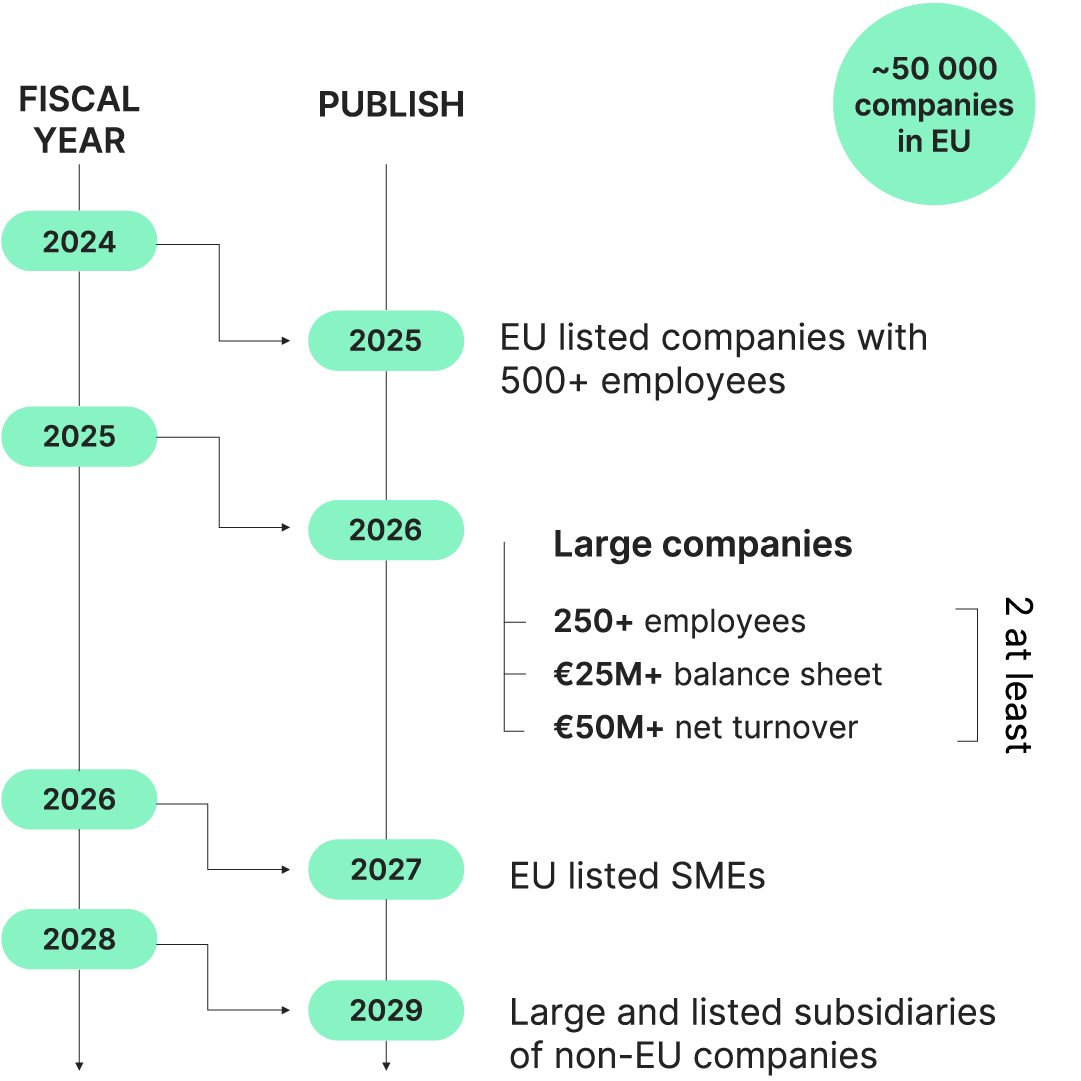

The first companies obliged to report are large public entities with at least 500 employees that have already been reporting under NFRD. They will have to prepare their sustainability statements for 2024 and publish them with financial reports in 2025.

In the coming years more companies will fall under the scope of CSRD, including listed SMEs and non-EU companies, for which dedicated standards are being developed. According to the European Commission, fewer than 12 000 entities are obliged to report this year. By 2029, when CSRD is fully implemented, this number is expected to grow to 50 000.

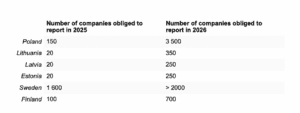

Number of companies obliged to report under CSRD in selected countries

Large companies with one year remaining before publishing their first CSRD report should consider this time as a final opportunity to get ready. While CSRD is a reporting directive, it’s much more than just a compliance task. By dedicating the months leading up to your report to a thorough analysis of your operations and value chain through the lens of sustainability, you can uncover insights that will serve as a strategic foundation for your company’s future.

With Civitta as your trusted partner, we’ll expertly guide you through every step of the CSRD process, ensuring you’re not just prepared — but strategically positioned for long-term success. We are currently supporting a number of companies across the Baltics in preparing their disclosures, covering a variety of sectors including real estate, construction, manufacturing, agriculture, media and ICT.

As Patrick de Cambourg, EFRAG Sustainability Reporting Board Chair, said:

“Quality, sustainability – related data is and remains a prerequisite for good governance, for sustainable value creation, for appropriate sustainable finance flows, for proper business and stakeholder relationships, for public policy decisions…”.

What needs to be reported?

CSRD sets the general rules of sustainability reporting, such as scope and timeline, whereas the reporting standards – known as the ESRS (European Sustainability Reporting Standards) – list all the required disclosures and data points.

They are divided into three main parts:

- ESRS 1 – General requirements explaining key concepts and assumptions

- ESRS 2 – General disclosures obligatory to all companies, and

- ESRS topical standards covering environment, social and governance aspects.

All together ESRS includes over 1 200 data points. However, disclosure requirements from the topical standards apply only if deemed material to the company, so the actual number of data points that will be reported is smaller.

The Commission has also announced that it plans to adopt sector – specific standards, the first of which should appear no sooner than in 2026. Work is currently ongoing on standards for sectors such as mining, quarrying & coal, oil & gas, road transport, financial institutions and textiles and accessories.

Where to begin?

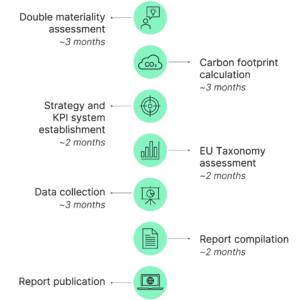

- Step 1 – Double materiality assessment

The DMA is essential for ESRS reporting, assessing both a company’s impact on ESG factors and how ESG issues affect its financial performance. It defines what to report and provides insights into sustainability risks, opportunities, and future priorities. ESRS focuses on the entire value chain, as companies can impact areas beyond their direct operations. Stakeholder engagement is key to identifying risks and opportunities, and companies have flexibility in choosing an engagement approach to gather the most relevant insights.

- Step 2 – Carbon footprint assessment

For most companies, climate change will be a material topic to report on, making it essential to assess their carbon footprint using the GHG Protocol, covering Scopes 1, 2, and 3. This includes emissions from both the company’s operations and its entire value chain. Understanding your carbon footprint is the first step toward creating effective transition plans and decarbonization strategies. After all, you can only manage what you measure.

- Step 3 – Strategy and KPI system establishment

ESRS 2 requires companies to explain how sustainability is considered in their strategy and business model. This is a great chance to review or develop your strategy if you haven’t already. A strong sustainability strategy is one that’s embedded within your overall business strategy, focusing on creating long-term value rather than treating it as a separate project.

- Step 4 – EU Taxonomy assessment

Companies must also carry out an EU Taxonomy assessment, as part of their environmental disclosures. The EU Taxonomy is a system that defines which economic activities are considered environmentally sustainable and what “sustainable” means for different sectors. Technical screening criteria, Do No Significant Harm (DNSH) principles… We’ve got it all covered!

- Step 5 – Data collection

As mentioned above, results of the double materiality assessment determine which data points shall be reported, therefore each company will have a different scope of the report, dependent on its sustainability impacts, risks and opportunities. Required data differ, particularly in topical standards, but generally data points can be divided into narrative, semi-narrative and numerical. Cross-departmental collaboration will be key in collecting the necessary data and making the process replicable for future years.

- Step 6 – Report compilation

The next thing to do is to compile the report, ensuring it is presented at a consolidated level if your company is part of a larger capital group. To ensure reliability of the sustainability statements, they will be audited, just as financial statements are. Initially audits will be carried out with limited assurance but a transition to reasonable assurance is planned.

- Step 7 – Report publication

Finally, it’s time to publish your sustainability statement! CSRD requires companies to incorporate it into their management reports alongside their financial statements. The use of digital tagging aimed at making the reports machine-readable is anticipated in the future.

Getting to step 7 will be rewarding, but will require appropriate planning and engagement across the company. The first report will require the most effort, while subsequent annual updates should be much more efficient if the right basis is established – documented, repeatable (and automated) processes and clear ownership will be the foundation for future success.

Why choose Civitta?

We deliver robust sustainability expertise, from impact assessment to compliance and reporting. Our mission is to empower organizations of all sizes and sectors, from local businesses to global leaders, to accelerate their sustainability journey with purpose and efficiency. Here in Civitta, our sustainability team consists of experts who work with EU regulations, sustainability reporting and carbon footprinting every day. We support our clients by leading projects with a flexible, tailored approach, providing convenient supporting materials and audit-ready deliverables.

We develop repeatable processes and educate your employees along the way, building the foundation for streamlined reporting in future years. Our sustainability advisory practice stands out because we understand the commercial realities of business and apply that insight to every step of the process. We empower organizations to accelerate their sustainability journey, enabling their ability to build resilience and create long-term value for all stakeholders.