Livonia Partners: carbon management across fund II portfolio

Client

Livonia PartnersClient Overview:

Livonia Partners is a private equity firm focused on building European leaders from the Baltic region outward. With over €240 million raised since 2015, the company invests in high-potential companies across the Baltics and supports them in scaling across Europe.

Since its founding in 2015, Livonia has partnered with ambitious entrepreneurs and management teams to deliver strong financial results while building companies that are resilient, responsible, and forward-looking.

Challenge:

By 2022, Livonia Partners had already established ESG as a core element of their investment strategy. The next step was to bring climate action into sharper focus by measuring and reducing the carbon footprint of their portfolio.

At the company level, portfolio businesses needed guidance on how to measure and manage their carbon footprints in a streamlined, repeatable way and translate the results into climate action.

This meant ensuring that all Fund II portfolio companies could calculate emissions consistently, interpret results meaningfully, and identify practical decarbonization steps. The challenge was twofold:

At the fund level, Livonia needed a credible way to calculate portfolio-wide financed emissions in line with international best practice.

Our Approach:

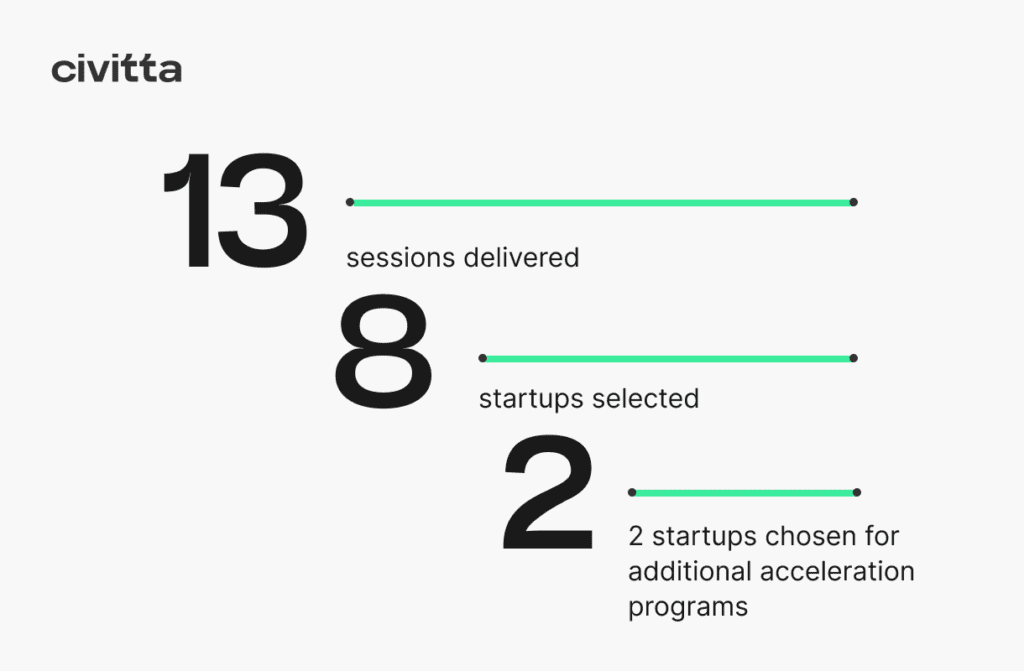

Livonia Partners has been partnering with Civitta since 2022 to make carbon management for all of their Fund II portfolio companies both accessible and impactful. Our approach was based on 3 principles:

- Make it easy

We understand carbon footprinting can be a daunting task for companies, so our aim as an expert partner is to cut through the complexity for them. We guided Livonia’s portfolio businesses through every step of the footprinting process, from identifying relevant Scope 3 categories to collecting appropriate data with our user-friendly templates. We explained what we were doing and why, so that in time, companies could feel empowered to take over measuring and managing their emissions inventory themselves. - Design with the end-goal in mind

Not all carbon footprints are created equal – the results are only as good as the data. Ours are designed to be decision useful, meaning we focus on getting high quality data where it matters most to underpin meaningful decarbonization recommendations. Livonia’s Fund II companies are in the manufacturing, ICT and wholesale sectors. Based on our knowledge of carbon hotspots across different sectors, we pinpointed the specific categories for which each company should collect more granular or supplier-specific data, even developing bespoke, technical calculations for Scope 3, Category 11: Use of Sold Products. We go the extra mile because we know that real action first requires an understanding of real impact. - Deliver practical recommendations

For each portfolio company, we developed a results dashboard and report which detailed the emissions hotspots and presented clear recommendations for decarbonization. We kept things practical and grounded in the local business context, for example by suggesting alternative suppliers in order to reduce the carbon impact of particular services.

Services provided:

- Carbon footprinting

- Portfolio emissions accounting

- ESG capacity building

- Decarbonization strategy

Results & Impact:

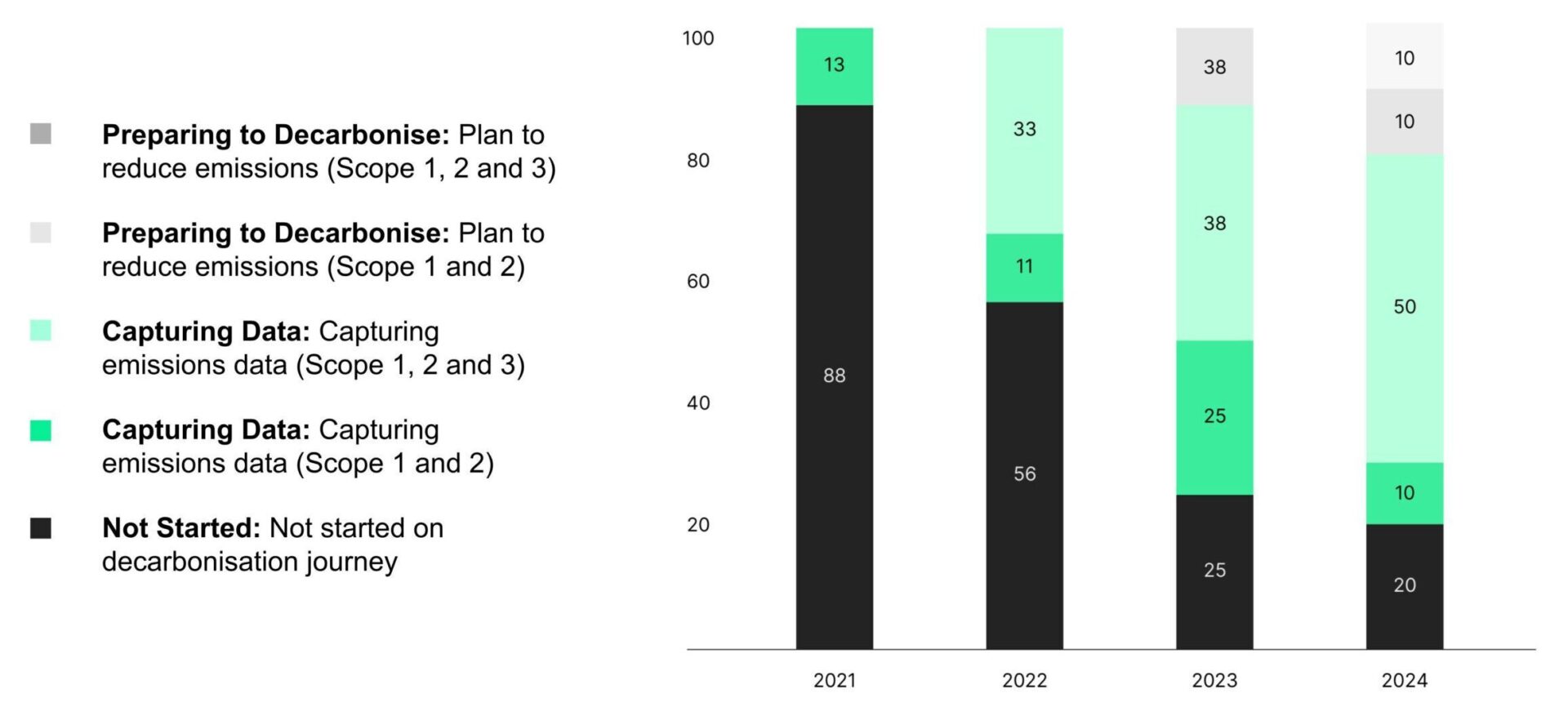

Within three years, our collaboration has transformed Livonia’s carbon management:

Comprehensive coverage: All Fund II portfolio companies now measure and report their carbon emissions. Livonia’s 2024 Sustainability Report highlighted the journey of expanding emissions reporting across the portfolio, and Civitta is proud to be their partner in making that happen.

Practical outcomes – portfolio companies are not just reporting but acting:

- Bestair developed an ESG strategy with the environmental aspect focused on prioritizing the sale of energy-efficient heat pumps, aligned to the decarbonization recommendations based on their footprint.

- For Wildix, we identified that the “use of sold products” category dominated their emissions profile, prompting engagement with suppliers to explore the potential of improving product energy efficiency.

- Bagfactory has incorporated more recycled materials into its manufacturing process, reducing the emissions impact of polypropylene in its Scope 3, Category 1: Purchased goods and services emissions.

- CSUB and Digmatix began procuring green electricity through either 100% renewable tariffs or guarantees of origin.

Improved reporting: At the fund level, Civitta calculated Livonia’s financed emissions using the PCAF (Partnership for Carbon Accounting Financials) methodology for financed emissions. This ensured that Livonia’s portfolio-level reporting met international standards, increasing credibility with investors and comparability with peers globally.

External recognition: The fund’s strengthened approach to embedding ESG practices into portfolio management has attracted external recognition – Livonia Partners received the ESG Champion of the Year award at the Real Deals Private Equity Awards 2024.

Stage of decarbonization journey, % of portfolio companies

Note: The chart above contains Fund I and Fund II companies.

Key Takeaways:

The Livonia case illustrates how companies can move from simply fulfilling ESG reporting obligations to driving real climate impact. Civitta’s role was to make carbon management easy, educational, and actionable: simplifying data collection, building company-level knowledge, and delivering practical recommendations on how each company could reduce their carbon impact.

Across sectors, Civitta empowers businesses to understand their carbon footprint and turn those insights into focused action and long-term business value.

Testimonials:

“For us, carbon management is not a box-ticking exercise — it’s about building the internal capacity of our portfolio companies to understand and act on their environmental impact. Working with Civitta has helped make this process practical and consistent across diverse industries. Each company now not only knows its emissions profile but also has a clear starting point for meaningful reduction actions.” — Sigita Žvirblytė, Head of Sustainability, Livonia Partners