Large company, are you ready to report your sustainability under CSRD?

More and more companies have started discussing their paths towards sustainable business and reduced climate impact. Even though many companies already realise their role in fighting against climate change, the European Commission wants to give an extra push.

As a result, the Corporate Sustainability Reporting Directive (CSRD) has been finalised and will replace the existing Non-Financial Reporting Directive (NFRD), 2014/95/EU from 2024. Consequently, the new reporting obligation will expand to 49,000 companies instead of the current 11,600.

What is it?

The goal of CSRD is to advance the existing NFRD´s requirements to support the higher aim of the EU Green Deal – reaching climate neutrality by 2050. With this goal in mind, the new directive sets obligations for sustainability reporting to the big companies and listed enterprises to report their business’s environmental, social, and governance (ESG criteria) activities while considering new advancements such as EU Taxonomy and Sustainable Finance Disclosure Regulation (SFDR), 2019/2088/EU.

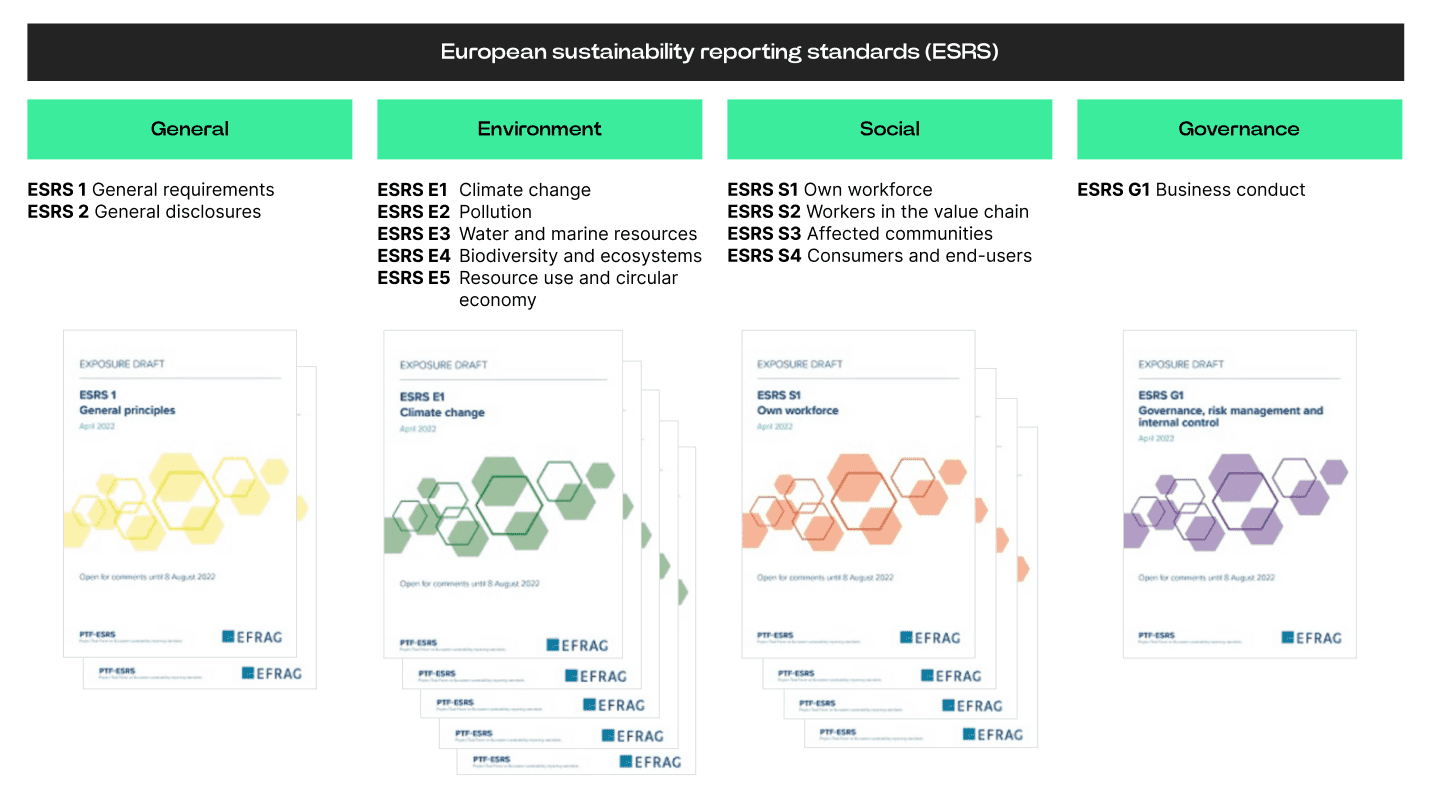

One of the goals of CSRD is to harmonise sustainability reporting in the EU. CSRD´s central element is the European Sustainability Reporting Standards (ESRS), which mandate the requirements and specific disclosures that must be followed in CSRD-aligned reporting.

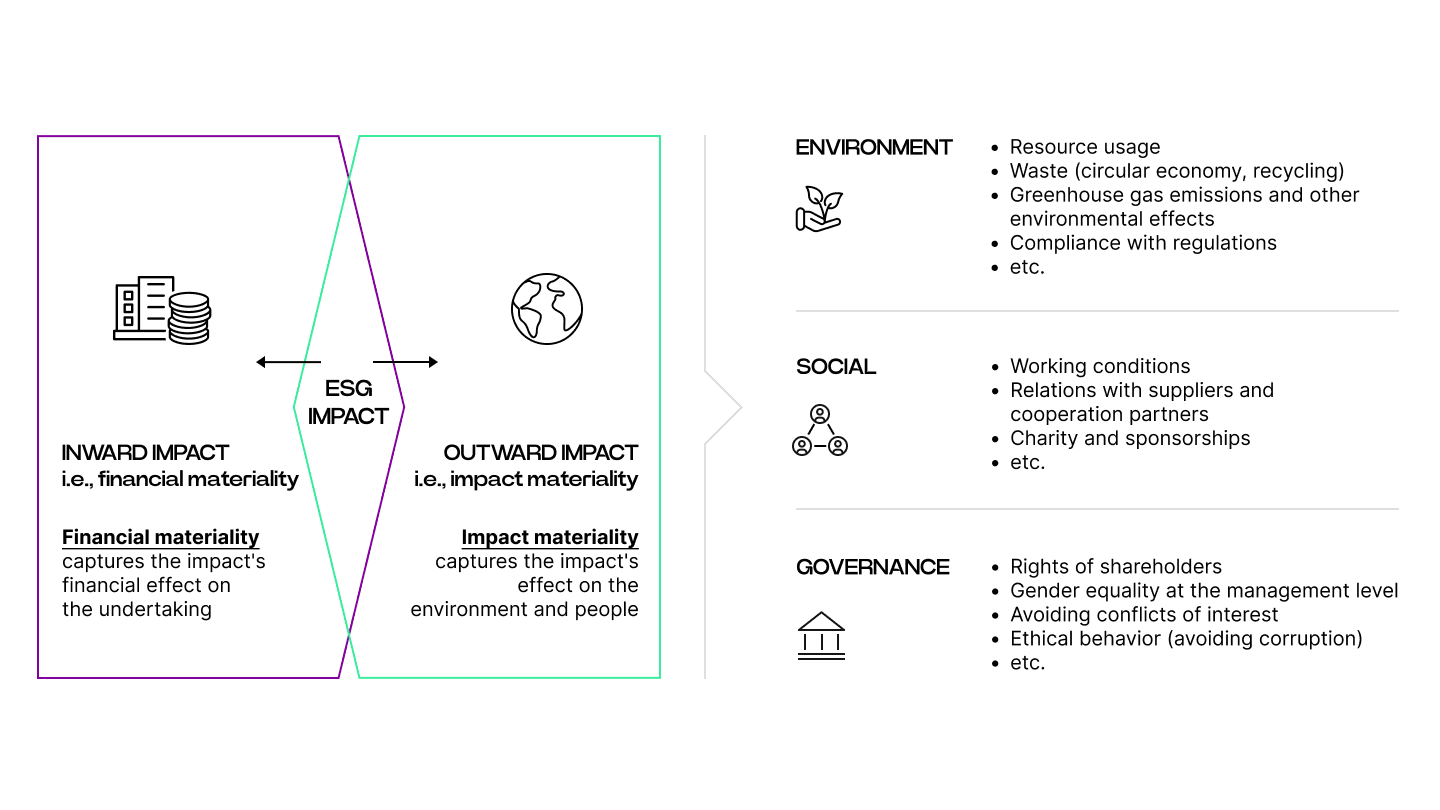

ESRS was adopted in July 2023. The Standards are divided into four themes, 12 standards, and >80 disclosure requirements (DRs). Disclosure topics for each organisation will be identified through a process called “materiality assessment”, during which a company shall identify and assess the most important impacts to the company itself (inward impacts, i.e., financial materiality) and to its stakeholders (outward impacts, i.e., impact materiality).

Only material topics are subject to CSRD reporting. A common framework ensures the comparability of reported information and helps to prevent greenwashing.

What is a large company?

CSRD applies to all large and listed companies (except listed micro-enterprises). CSRD’s definition of a „large company“ differs from NFRD, setting three thresholds, out of which two must be fulfilled in the organisation´s previous financial year:

- 250 employees

- ≥ €40 million in net turnover

- ≥ €20 million in assets

The company´s size estimation must also account for its parent companies, subsidiaries, and sister companies.

Further clarification is yet to be provided about whether other associated companies (exempted from the group’s consolidated annual report) should be disclosed under CSRD.

What obligations shall be fulfilled?

The foundation of CSRD reporting is the principle of double materiality, requiring the companies to disclose how external factors affect the company´s operations (inward impact) and what effect the company´s operations have on the people, society, and environment (outward impact).

The list of disclosable topics is relatively wide, including subjects such as:

- Sustainability goals and their implementation progress

- Board´s role and responsibilities within sustainability

- The company’s sustainability policy, including the due diligence process

- The effect of the Paris Agreement´s 1.5oC warming on the company

- Negative sustainability influence in the value chain

- Sustainability risks

According to current plans, the published information will be subject to a mandatory (limited) assurance.

When to prepare?

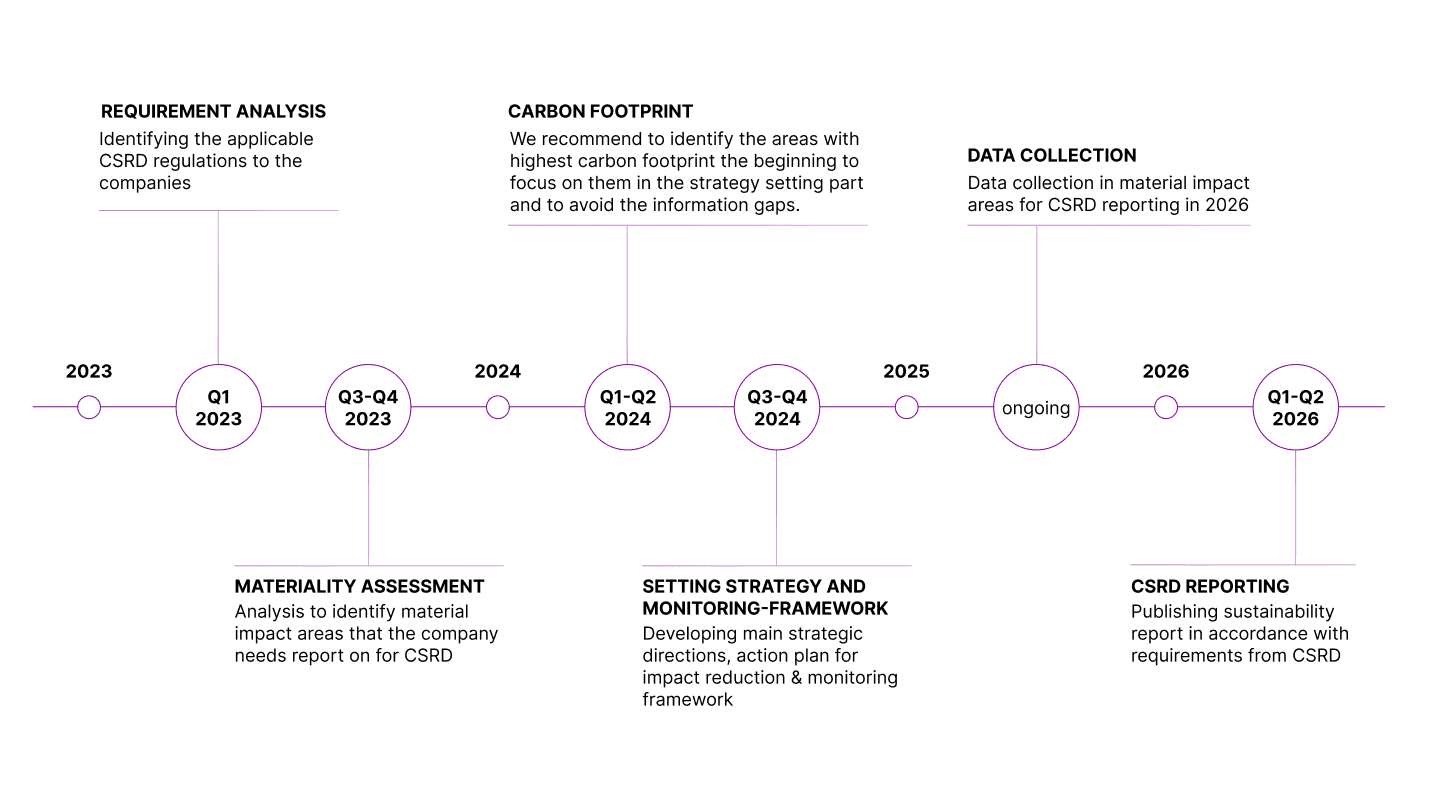

CSRD rules are expected to start applying in 2024 when companies need to begin collecting necessary information on their business activities. First, the reporting obligation extends to NFRD-defined large companies (listed companies with over 500 employees) that must publish their first CSRD-aligned report in 2025.

From 2026, every large company (not listed) will be subject to CSRD. The obligation will be extended to the listed small and medium-sized enterprises (SMEs) in 2027.

From 2026, every large company (not listed) will be subject to CSRD. The obligation will be extended to the listed small and medium-sized enterprises (SMEs) in 2027.

That means large companies covered by NFRD (listed companies with >500 employees) must start preparing to identify the essential sustainability-related information and establish the needed processes for the data collection. This is the only way to prepare for the ongoing (rather than reactive) and systematic data gathering in 2025 and subsequent publishing in 2026.

The first step would be to measure the organisation´s environmental impact through carbon footprint analysis (read more from our other article here) and establish a sustainability strategy, relevant KPIs and monitoring processes.