The Baltic Startup Scene: Today’s Realities, Tomorrow’s Possibilities

The report commissioned by Google

Civitta, in collaboration with GOOGLE, has prepared the most extensive report ever on the startup ecosystem in the Baltics. The results show that the growing number of startups is already generating significant economic growth, with the potential for an even more significant impact in the future. However, the challenges of finding funding and talent are slowing the pace at which startups can scale.

Creating a startup is a hard job – we know that well! That is why we decided to dive deep into the startup ecosystem to assess its health, measure its economic impact, and look for ways to make that impact many times bigger. We hope this report will be a helpful guide and help other ecosystem players support startups in their journey. The report draws insights from desk research, interviews with major players in the startup ecosystem, and surveys of startup founders and potential employees.

Baltic startup ecosystem’s potential is evident

Recent years have witnessed a growing number of startups in all three Baltic countries. Estonia has the lead in this race with the largest number of startups (1,300+), followed by Lithuania (1,100+) and Latvia (600+).

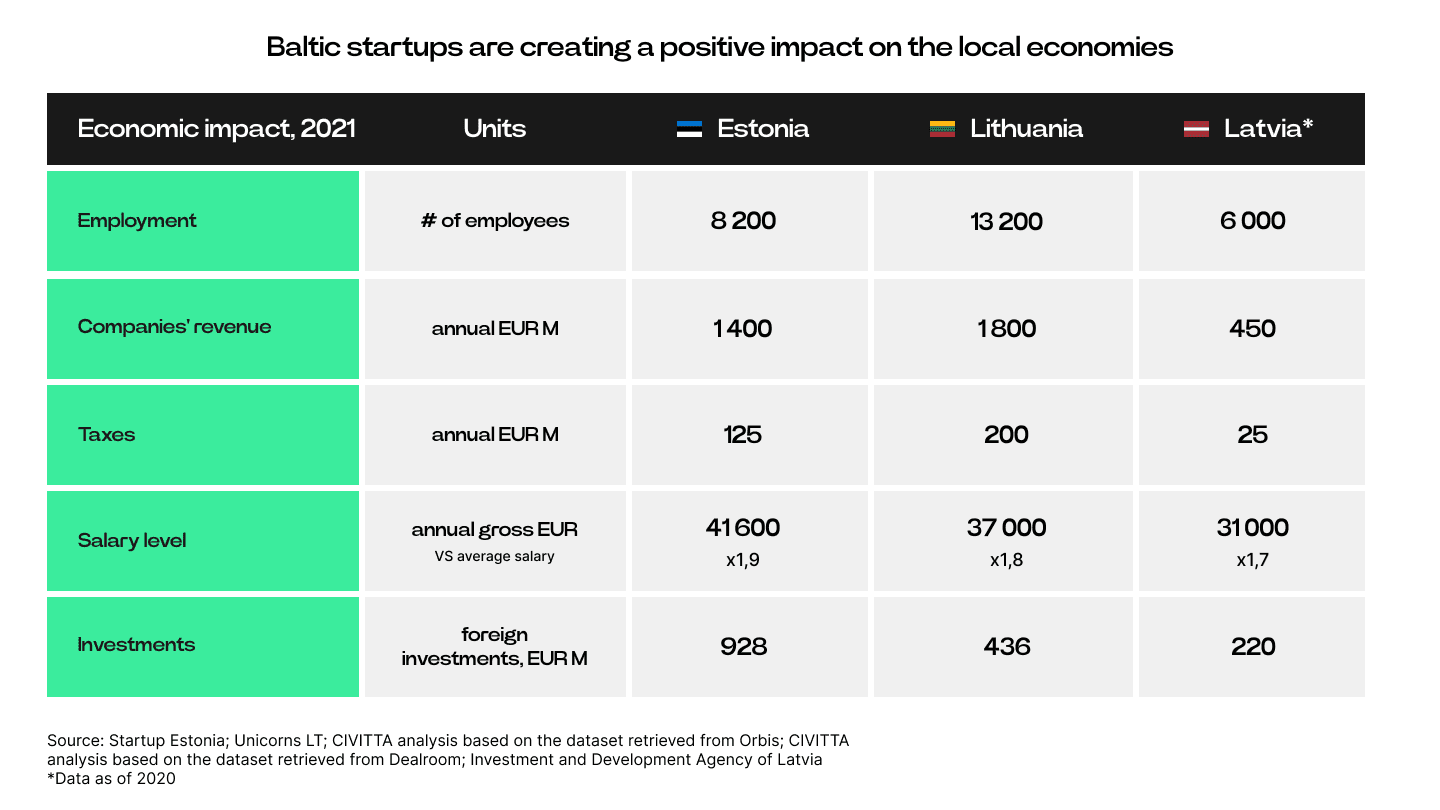

Revenues in the startup ecosystem are now large enough to impact each country’s economy directly. In 2021, they totalled EUR 1.4 billion in Estonia, EUR 1.8 billion in Lithuania and EUR 0.4-0.5 billion in Latvia. This also means that a significant amount of taxes are paid into state budgets and startup industry employees earn almost twice the average pay in their countries.

Most startups in the Baltics are also helping to elevate business culture with their focus on sustainable business models, employee well-being, clean energy, industry innovations, and climate goals.

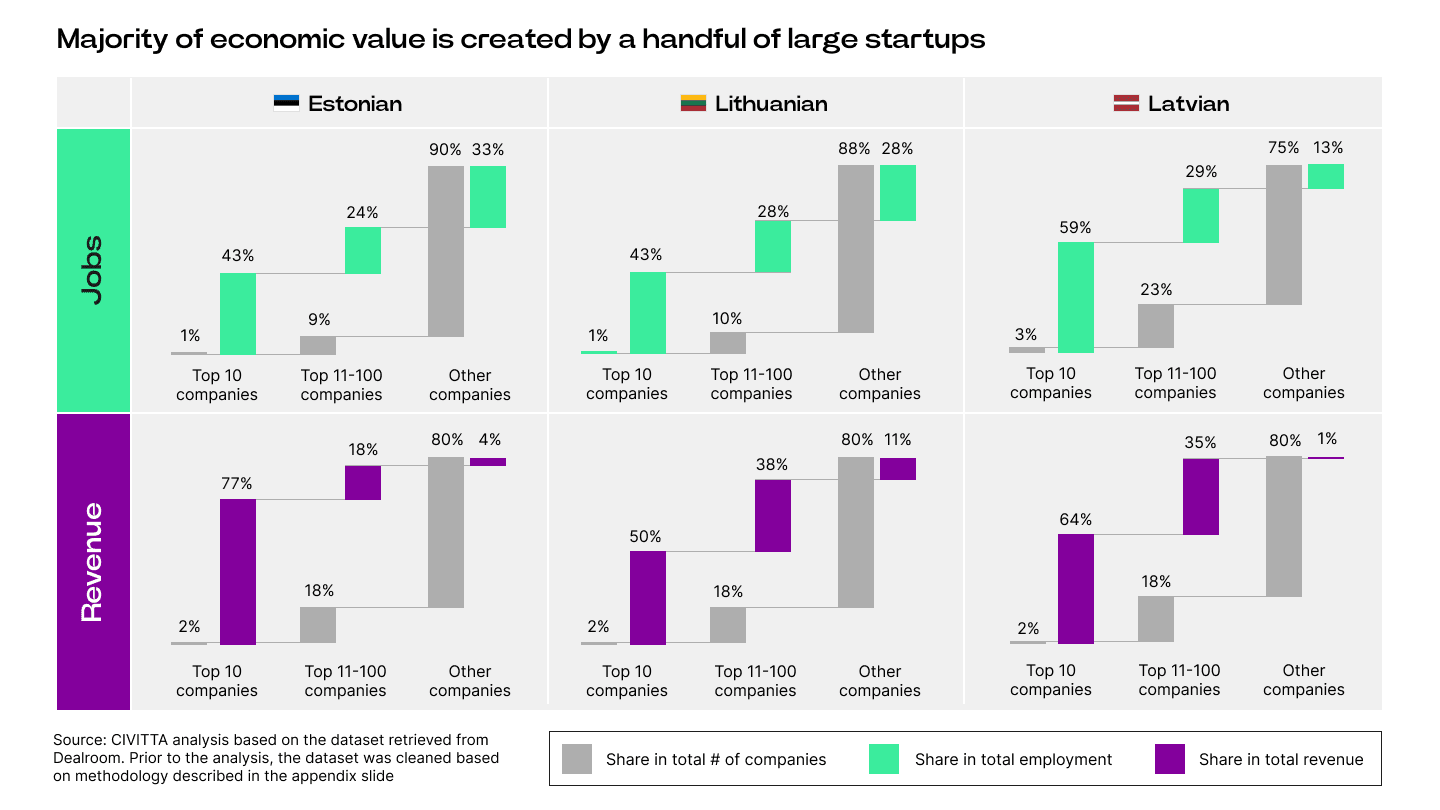

The report shows, however, that among the seemingly large total number of startups, only a few have reached a notable size in terms of revenue, funds raised and employees.

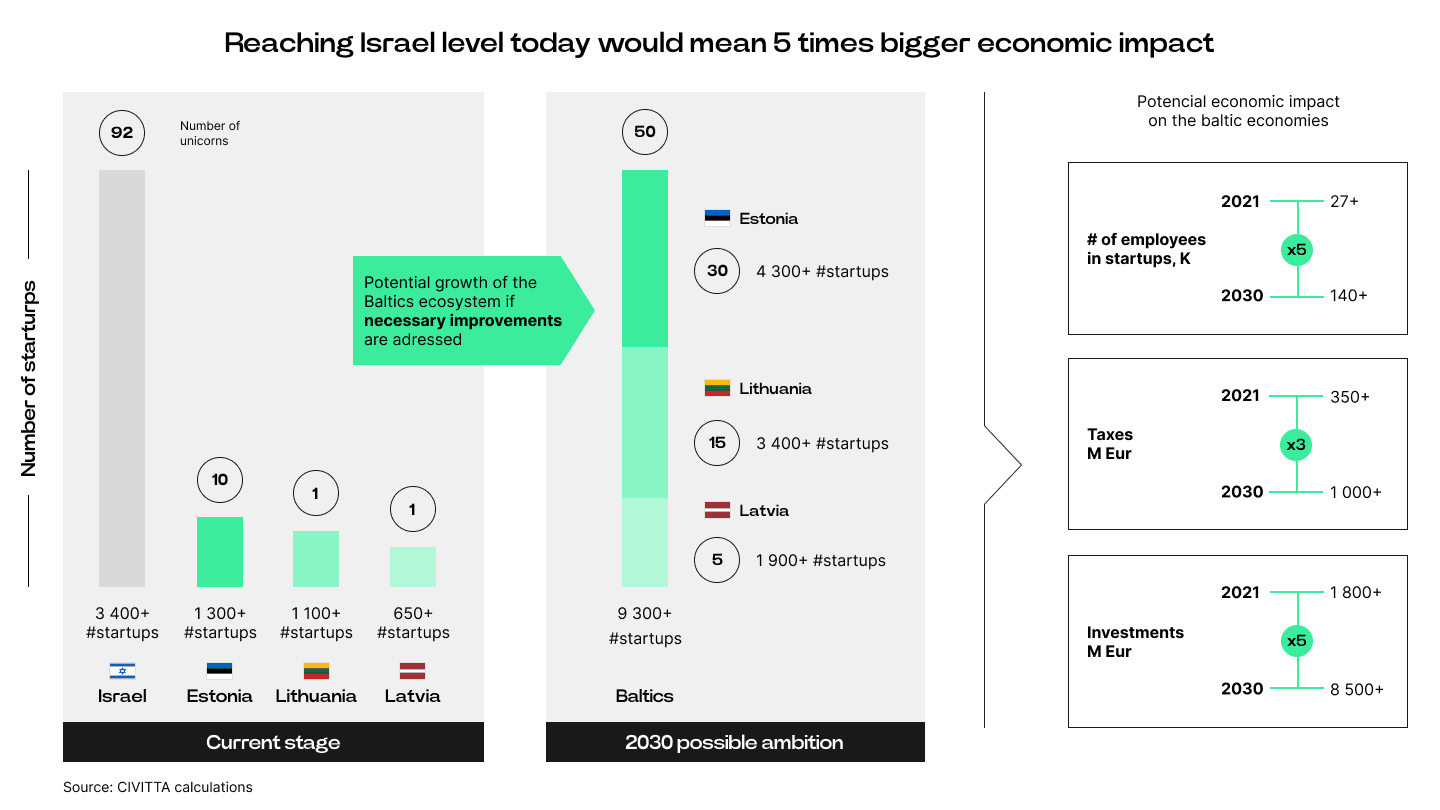

Clearly, startups have a huge potential to become major contributors to the Baltic region’s economies. If we could reach the level of Israel’s startup ecosystem today, the economic impact would be five times bigger.

To raise the ecosystem to the next level, the Baltic countries need more very successful startups (so-called “scaleups”), potentially employing thousands of people and generating significant revenues.

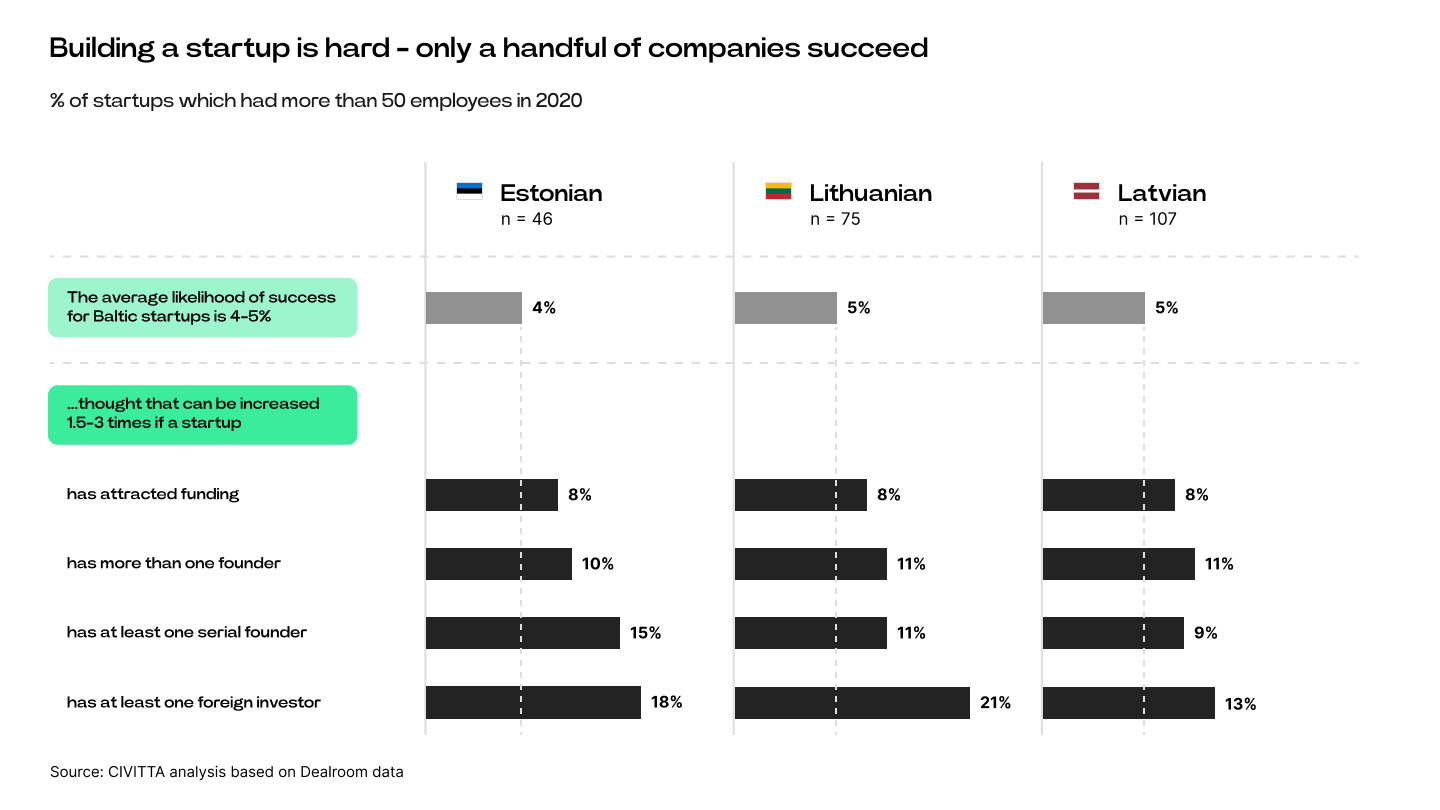

Baltic reality: only 4-5% of startups in the region succeed

The number of startups in the Baltics grows every year, but only a few manage to scale up and become successful businesses. Sadly, a rather significant slice of the startup pie in the Baltics involves companies with less than 20 employees still struggling “to hit the glow-up”.

We asked startup founders what the main challenges are that are preventing startups from growing in the ecosystem. They named two: the shortage of top-tier employees and the shortage of funding.

Leveraging stock options is important in attracting top talent

People in the Baltics are entrepreneurial. A survey shows that 1 in 5 people would consider founding a startup themselves. Working at a mature, well-known startup is also considered an attractive career option.

Small and more recently founded startups don’t benefit from such attitudes when recruiting, though. According to the survey, people in the Baltics see them as riskier employers. They would require a roughly 40% higher salary to consider joining a new startup than a mature one.

Globally, the most common approach to talent shortages at any startup stage is offering stock options more widely (not limiting them only to the founders).

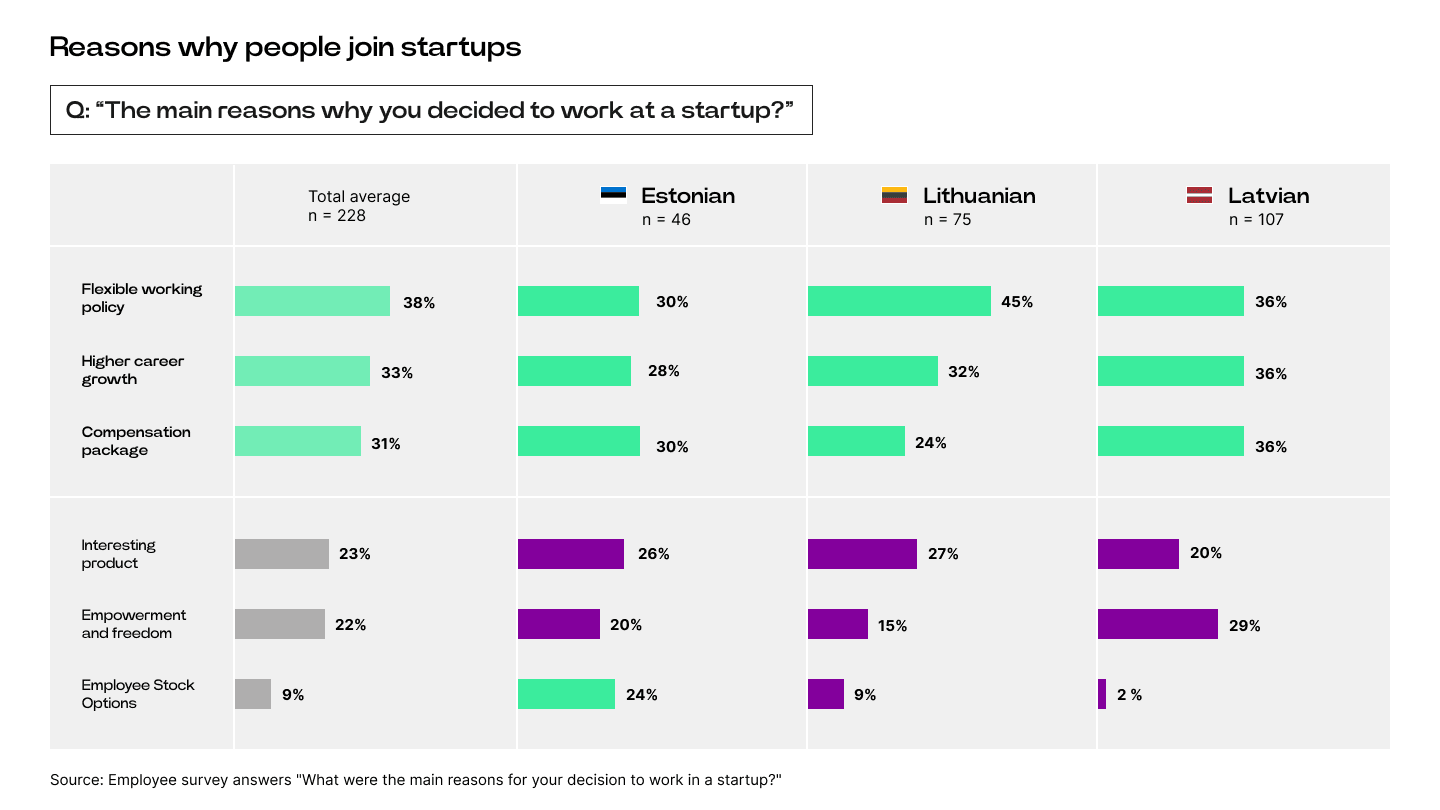

The employee survey shows that stock options are not widely used or understood in the Baltics, especially in Latvia and Lithuania. Only 9% of people working in startups in Lithuania said that was the main reason for joining, and just 2% said so in Latvia.

By contrast, in Estonia, where stock options are more widely used, 24% of people who work at a startup said that was the main factor in their decision to join the company.

The employee survey also shows that the more people know about stock options, the more they consider them important when joining a startup.

This is especially relevant for startups seeking to attract the types of talents in the highest demand in the Baltics: C-level executives and IT and engineering specialists. The study shows that these professionals know quite a bit about stock options, can understand their value, and might even have a financial cushion, enabling them to go with a lower salary and a good stock options package.

Employee stock options are also essential for the ecosystem’s long-term success. In the event of a major success – say, an IPO or an exit – employees can earn a large amount of money from shares they own, allowing them to become angels themselves, invest in other startups, and mentor others… sparking a so-called flywheel effect.

Attracting funding requires patience and resilience

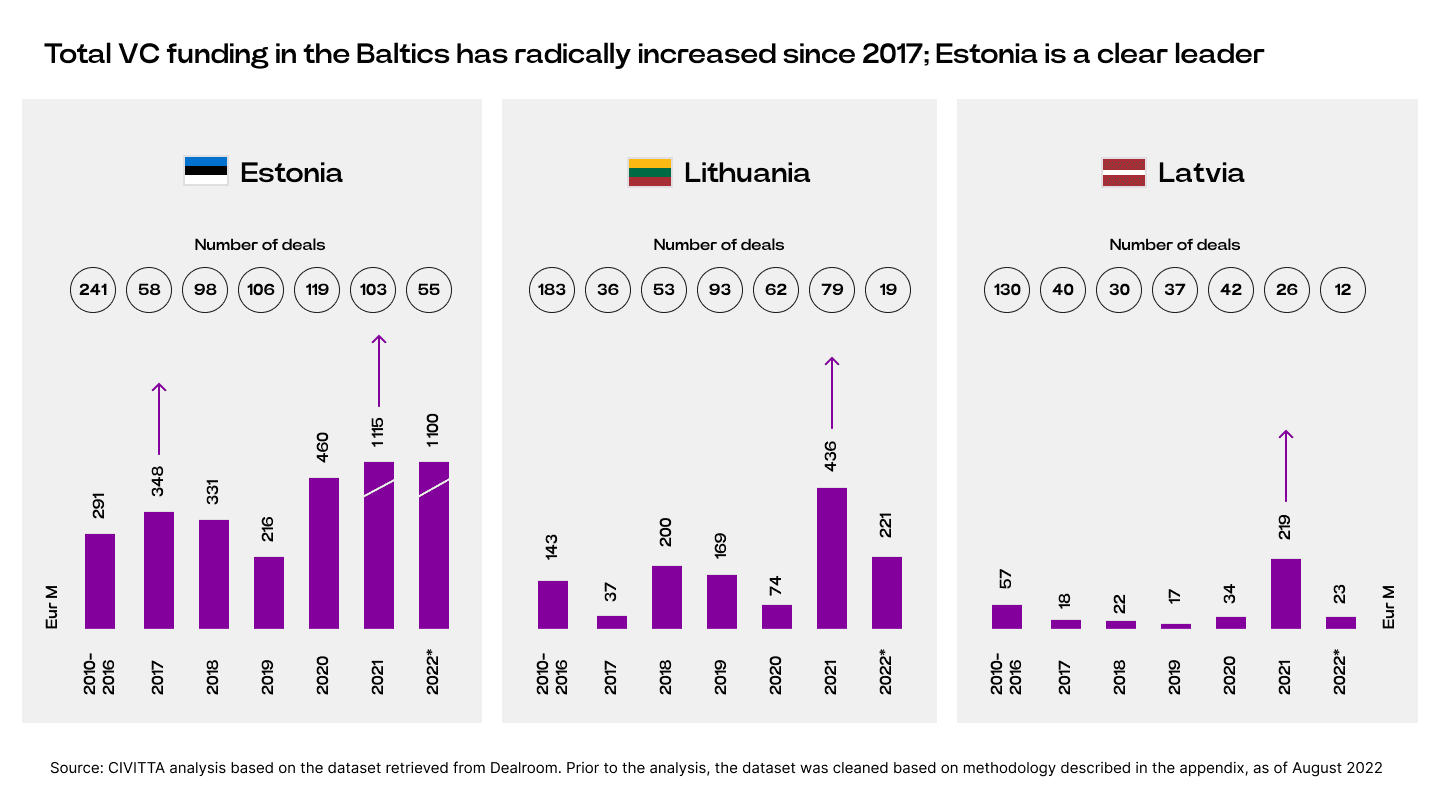

Since 2017, venture funding in the Baltics has increased dramatically. The speed of growth in funding has accelerated as well. It takes less time to move to subsequent rounds. However, funding options remain the predominant challenge in the Baltics startup ecosystem.

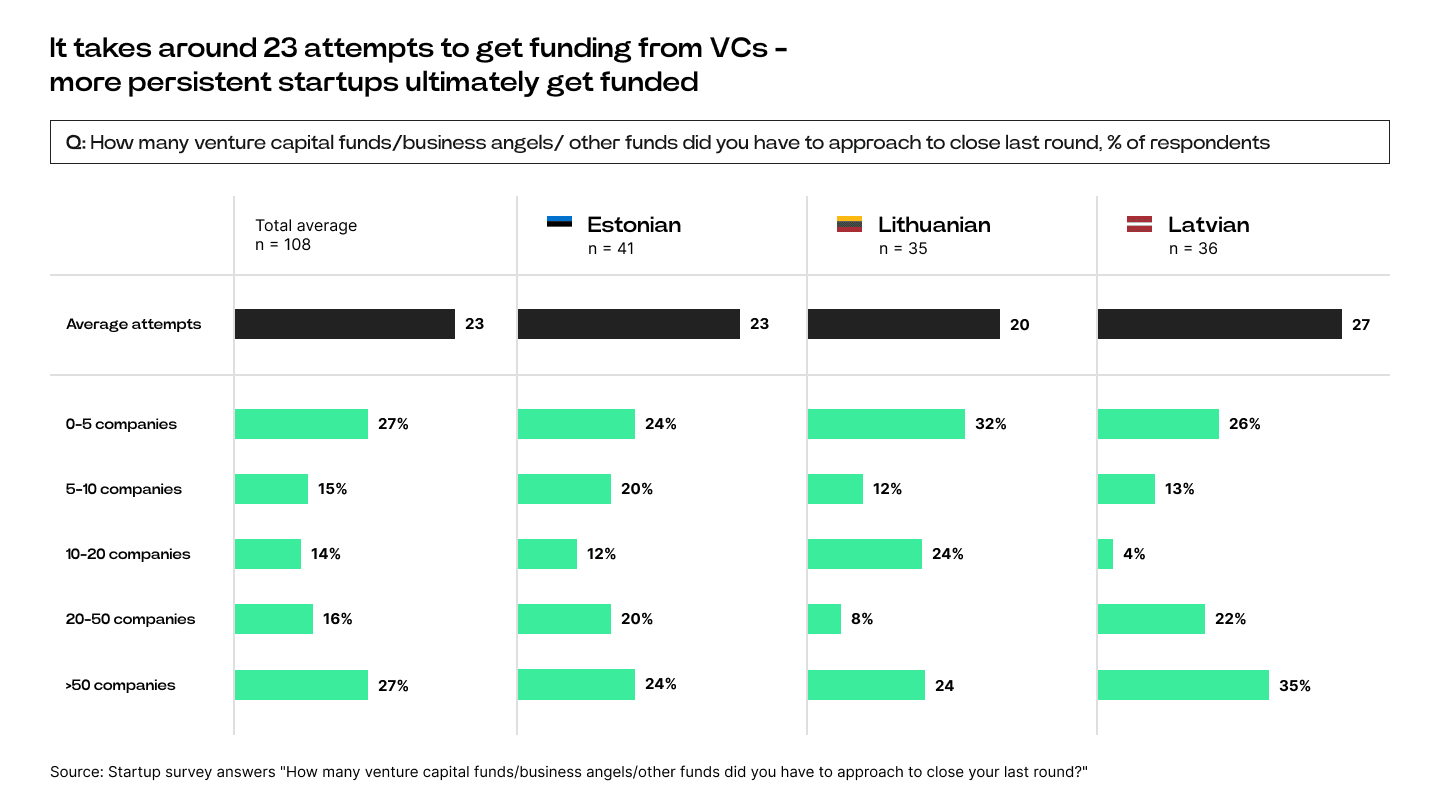

One of the study’s most interesting findings is that resilience and persistence play a huge role. It takes, on average, about 23 approaches to sources of venture capital to get funding – more persistent startups ultimately succeed.

In addition to that, having a serial founder on the team correlates with greater success in attracting funding: 65% of startups that attracted funding in Estonia, 58% in Lithuania and 59% in Latvia had at least one serial founder on their teams. Having a serial entrepreneur on the team also correlates with successfully attracting foreign funding, which becomes very important as startups get more mature and need larger amounts of money to grow.

The clear implication for young startups is that you need to grow your network to ask for help and mentorship and, ideally, invite a serial founder to join your founding team. That would increase your chances of success significantly.

This discussion also highlights the importance of networking and know-how in the startup ecosystem. Creating more opportunities to network and exchange knowledge with serial founders would benefit the entire system. The work of startup associations like Unicorns Lithuania, Estonian Founders Society and others is vital.

Engagement with EU policy is an opportunity for startups

Interviews with startup founders showed that Baltic startups are in the unique position of being in direct communication with the authorities and being able to affect policy-making processes in the Baltics.

However, the startup ecosystem requires more than engagement with local policymakers, as digital markets are increasingly regulated by EU legislation, which is drafted and debated in Brussels.

One notable recent example is the General Data Protection Regulation (GDPR), which has dramatically impacted all businesses globally.

Therefore, startups that want to grow beyond the limits of the Baltic states and establish themselves in global or EU markets need to follow EU digital policy and actively participate in EU legislative processes.