Better market connectivity of Ukraine to the EU – Comprehensive Market Analysis and Support Activities

Client

Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ)The Background

How does the Ukrainian–European market operate? Which Ukrainian goods and services are gaining traction among EU consumers? And most importantly, how can both sides benefit economically through closer cooperation?

These were the key questions at the heart of a project commissioned by our client, GIZ (the German Agency for International Cooperation). They tasked us with exploring the Ukrainian small and medium-sized enterprise (SME) landscape to pinpoint the most promising sectors, sub-sectors, and product categories that could drive growth, generate employment, and align with the evolving demands of the EU market.

To answer these questions, we adopted a multi-layered approach — blending data-driven analysis with input from local experts. Our focus was on assessing Ukrainian SMEs based on their export performance, growth outlook, revenue potential, and ability to create value. But the work didn’t stop at analysis. We also partnered with key Ukrainian business support organisations (BSOs) in five priority sectors to offer targeted mentorship, capacity building, and market access support — equipping businesses to thrive on the international stage.

What emerged was not just a snapshot of current capabilities, but a strategic overview of Ukraine’s economic potential — including where investment should be focused and how the country can position itself more competitively in the European marketplace.

Project Purpose

At its core, the project set out to understand Ukraine’s place in the European trade landscape — not only where the country stands today, but what’s needed to unlock its full potential.

We weren’t just looking to map the terrain — we aimed to shift it. The mission was to turn insights into impact, helping SMEs and the organisations that support them to overcome barriers, scale their operations, and step confidently into wider European markets.

Crucially, the project placed emphasis on long-term outcomes: increasing Ukraine’s production capacity, strengthening its trade links, and building a more resilient, connected SME sector that contributes meaningfully to economic recovery and future growth.

Methodology

The entire project was structured around five interlinked Stages (Work Packages) — each stage building upon the last to form a clear, strategic pathway from research to real-world results. Particularly, among them: Identification and Assessment of Ukrainian Industries, Assessing the Stakeholder Environment and Identifying Key Players, Capacity Building of Ukrainian Industry Associations, Matchmaking and EU Stakeholder Engagement, and Communication and Visibility.

Each stage was supported by clearly defined activities and deliverables, ensuring progress was measurable and aligned with the broader aims of the project.

Services provided & Results

Stage 1: Identification and Assessment of Ukrainian Industries.

To identify the most promising areas for Ukrainian SMEs within the European market, we took a step-by-step approach. This involved aligning classification systems, establishing clear selection criteria, carrying out in-depth quantitative and qualitative analysis, and evaluating geographical export opportunities. Thus, we:

- Harmonized the NACE and HS classification systems to provide a more structured and meaningful view of Ukraine’s economic landscape.

- Developed a clear set of selection criteria, taking into account export viability, the presence and dominance of SMEs, and the role of the sector in the value chain. As a result, narrowed the scope to areas with real potential for growth and impact.

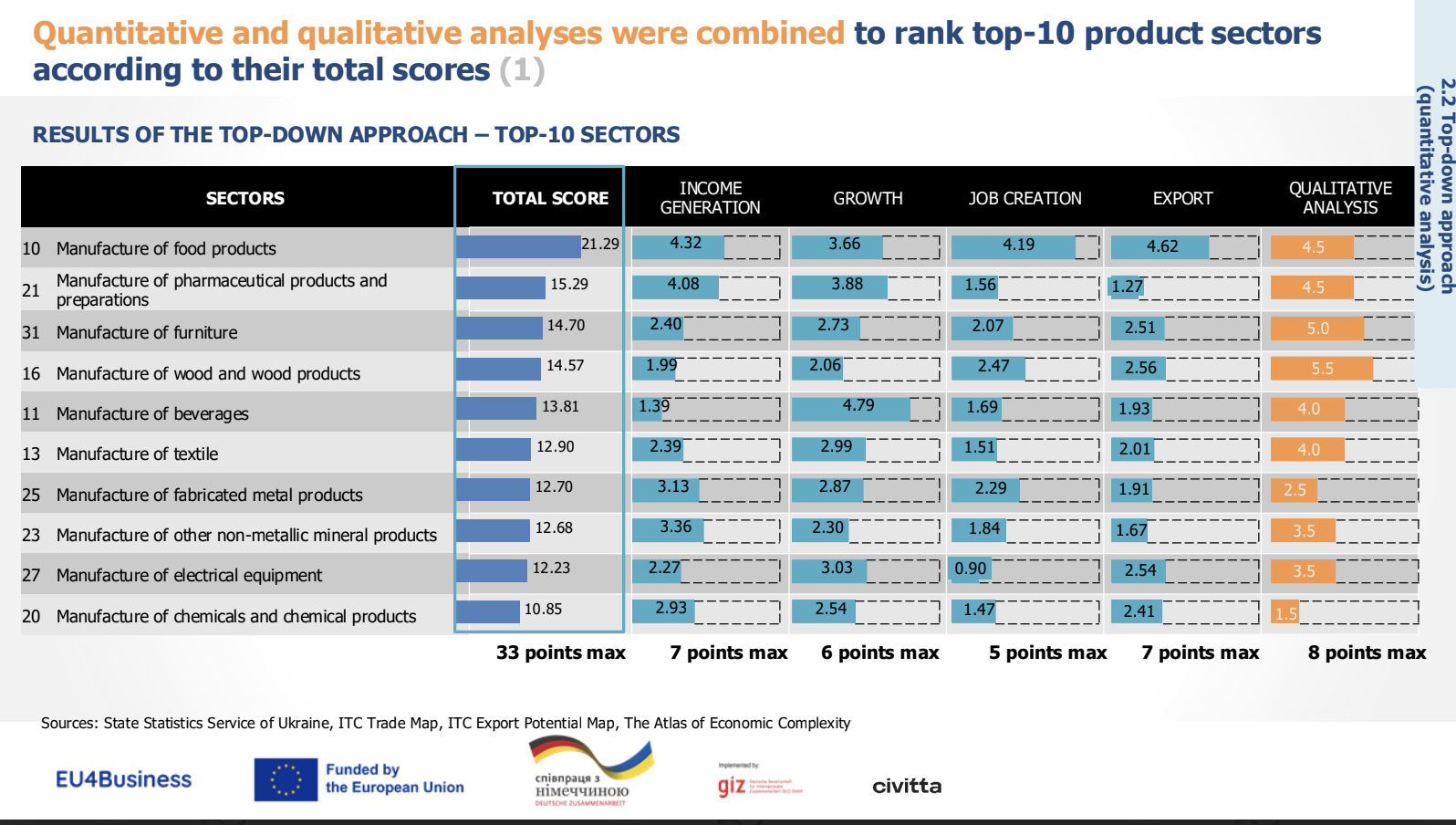

- Conducted a quantitative analysis based on 25 indicators, distributed across four dimensions — income generation, growth potential, job creation, and export performance.

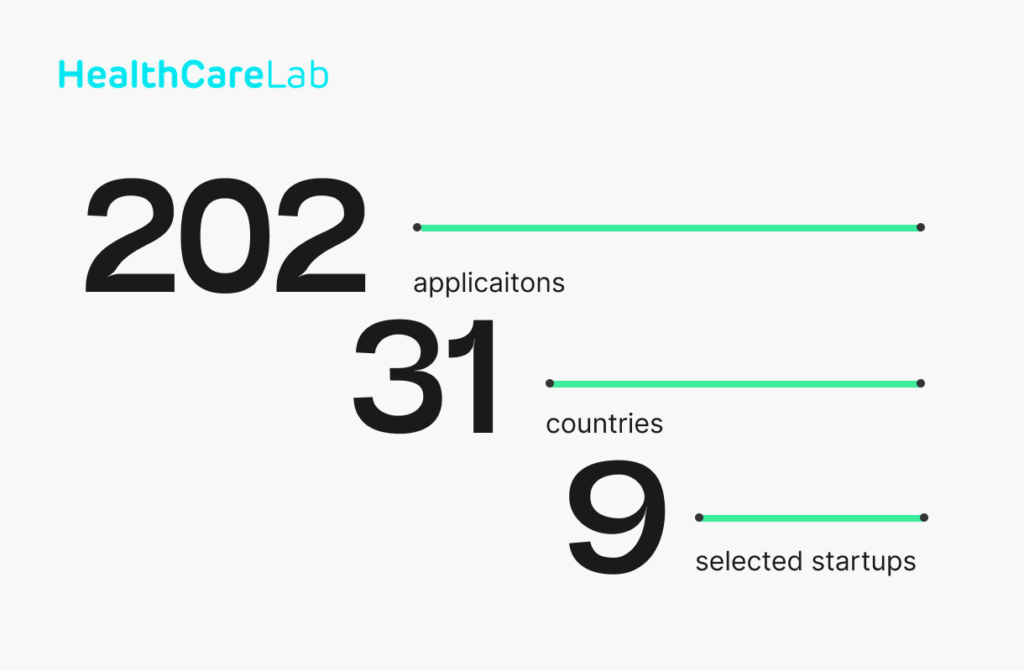

- Conducted a qualitative assessment to add context and insight that only on-the-ground experience can provide.

- Identified ten particularly promising SME sectors. Of these, five rose to the top — competitive product and service sectors with high potential that are already in demand on the EU market: food; wood and wooden furniture; clothing and home textiles; lighting equipment and household goods; and ICT services. The remaining five demonstrated strong export potential: pharmaceuticals, non-metallic minerals, metal products, beverages, chemicals, transport solutions and packaging.

- Filtered out subsectors that were less promising or less relevant to Ukraine’s medium-term recovery needs.

- Assessed European markets based on demand levels, export potential and barriers to entry. From this, five countries stood out as key target groups for Ukrainian exports: Poland, Germany, the Netherlands, France and Italy, each offering a strong combination of opportunities and accessibility.

Promising SME sectors

Stage 2: Assessing the Stakeholder Environment and Identifying Key Players.

To create a solid foundation for the project, we began by identifying the most active and relevant Business Support Organisations (BSOs) across key sectors. This helped us understand who is best placed to support Ukrainian SMEs and who we could partner with in future. Particularly, we:

- Carried out extensive research through desk-based analysis and a bottom-up approach to gain a clear understanding of the landscape.

- Began by compiling a list of 91 Business Support Organisations (BSOs) across five priority sectors — food, woodworking, textiles, electrical equipment, and ICT. Our selection was based on key criteria such as the size of the organisation, the sector’s overall value, and the BSO’s level of activity.

- Narrowed this down to 15 promising organisations and began reaching out, using warm contacts and support from local experts.

- Each BSO was assessed for its readiness to take part in the project — we looked at how responsive they were to requests and whether their activities were strategically aligned with the project’s goals.

- By the end of this phase, we had developed a detailed map of key Ukrainian BSOs within the five target sectors, providing a strong foundation for the next stage of the work.

Stage 3: Capacity Building of Ukrainian Industry Association.

At this stage, we set out to strengthen Ukrainian industry associations so they could better support their members in entering and thriving in EU markets. Here’s what we did:

- Assessed each organisation’s capacity to support its member companies in exporting to the EU.

- Evaluated their training needs to identify key priorities for professional development.

- Created tailored Capacity Building Plans for each organisation, using SWOT analyses and drawing on input from both national and international experts.

- Delivered a training programme that included nine export-focused modules, one-to-one international strategy workshops, and group sessions on working with EU partners and preparing for market entry.

- We also coordinated matchmaking activities with potential European partners and supported the organisations in establishing new contacts and building long-term partnerships.

- As well as delivered additional training modules on Authorised Economic Operator (AEO) certification, the application of AI in business, private labelling, financial management, and strategies for generating revenue.

Stage 4: Matchmaking and EU Stakeholder Engagement.

To boost connections between Ukrainian SMEs and their European counterparts, we organised a range of activities designed to foster networking, learning, and long-term collaboration. This stage included:

- Organised and coordinated visits to four major European trade fairs — Biofach in Germany (food industry), Première Vision in France (textiles), TechArena across Finland and Sweden (ICT), and Meble Polska in Poland (wood, furniture, and electrical equipment). These events gave our participants to see the market up close and connect with key players.

- Arranged targeted networking events for B2B engagement, working closely with EU Business Support Organisations in Germany, Poland, Finland, and France. These sessions helped build valuable relationships and opened doors for collaboration.

- Ran sector-specific study tours. These were designed to give participants real insight into EU market trends and consumer behaviour—knowledge that’s crucial for success abroad.

- Signed 24 Memorandums of Understanding and 32 Letters of Intent, laying the groundwork for long-term partnerships between Ukrainian and European businesses. Additionally, 40 potential clients or partners expressed concrete interest through documented Requests for Quotation (RFQs) or follow-up email exchanges requesting additional information, indicating commercial intent and the early stages of business negotiation.

- Organised additional events to keep the momentum going, ensuring ongoing interaction and cooperation with EU stakeholders well beyond the initial meetings.

Stage 5: Communication and Visibility.

To raise awareness and share our progress, we focused on communication and outreach. This involved publishing press releases and articles, sharing success stories widely, and organising a flagship public event to highlight our research and spark meaningful discussions.

- Published three press releases in Ukrainian and international media outlets.

- Published three authored articles in leading Ukrainian business publications.

- Shared success stories on partner platforms and promoted them through social media channels.

- Organized a flagship public event that featured a research presentation and a panel discussion.

Better market connectivity of Ukraine to the EU

Identification of the most promising sectors, subsectors, product and service categories, and EU markets.

Download