The background:

The National Bank of Uzbekistan (NBU) is the largest financial institution in Uzbekistan, providing a comprehensive range of banking, financial, and investment services to individuals and businesses. As part of its digital transformation strategy, NBU aimed to modernize its website, replacing an outdated platform with a high-performance, scalable, and user-friendly digital experience.

The previous website had several challenges, including:

- Limited self-service options, making it difficult for customers to manage their banking needs online.

- Inefficient content management system, requiring manual updates and technical intervention.

- Lack of third-party integrations, restricting automation and recruitment efficiency.

- Slow page speed and performance issues, negatively impacting user experience and SEO rankings.

To solve these challenges, NBU partnered with Civitta, leveraging its expertise in banking technology solutions to create a future-proof digital banking platform that improves user engagement, content management efficiency, and operational scalability.

The Essence of the Project:

Civitta’s goal was to develop a high-performance digital banking platform with a customer-centric design, modular architecture, and top-tier security. The project involved:

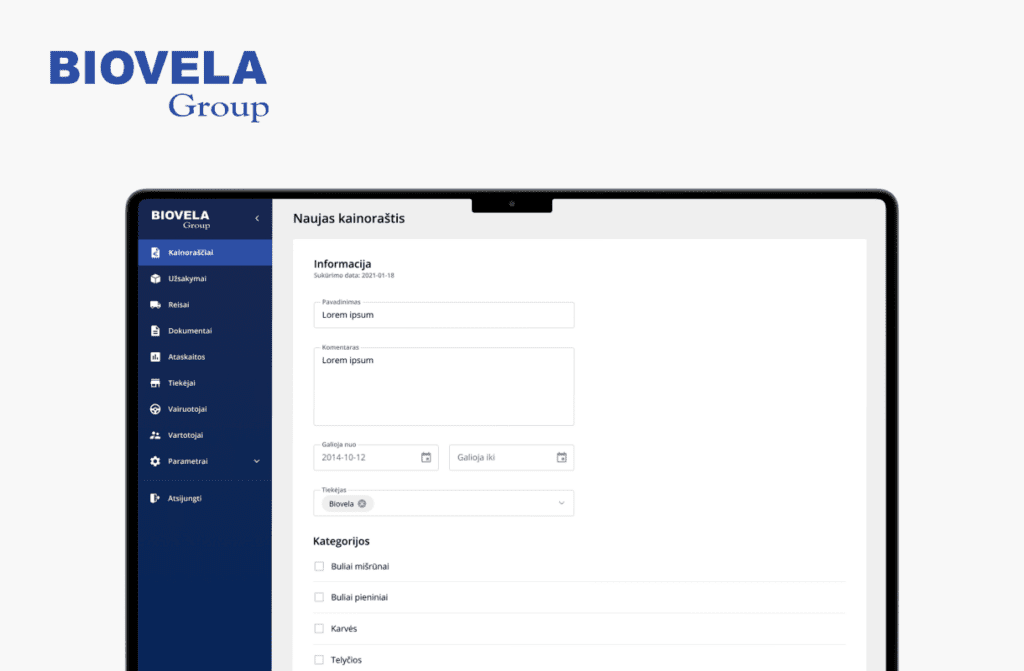

- Modern CMS Upgrade: Transitioned to Statamic CMS, allowing non-technical users to update content independently and more efficiently.

- Drag-and-Drop Page Builder: Introduced a no-code solution, enabling content managers to create custom landing pages in just 30 minutes without needing developer assistance.

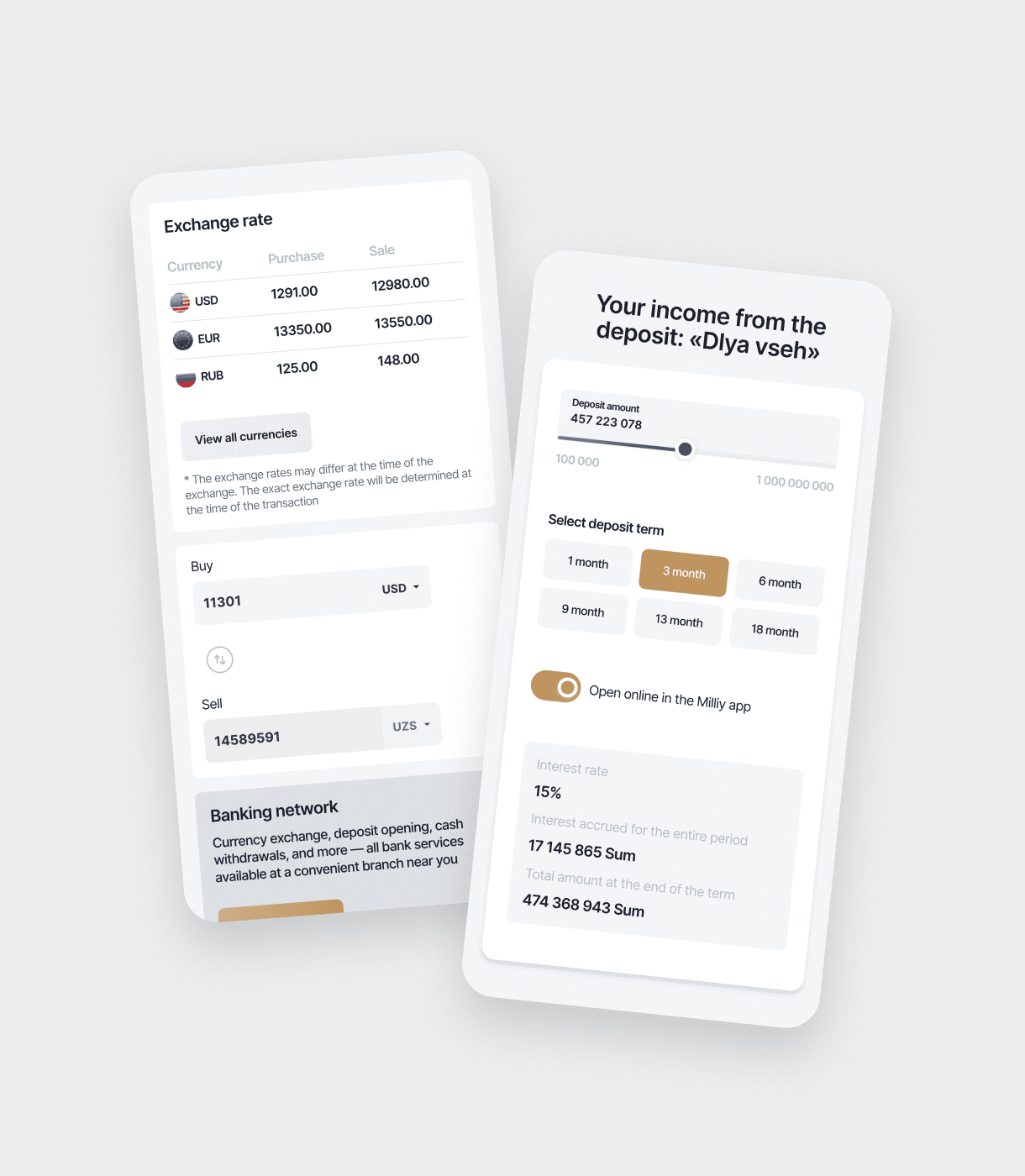

- Advanced Loan and Deposit Calculator: Implemented automated calculations that adapt to client parameters, offering a seamless user experience.

- HeadHunter API Integration: Enhanced job listing management by archiving removed postings, ensuring better visibility in search engine results.

- Performance Optimization: Implemented caching, image compression, and faster page loading times, reducing bounce rates and improving Google PageSpeed scores from 17 to 100 (desktop) and 25 to 95 (mobile).

- Security & Compliance: Integrated OAuth 2.0 authentication, SSL encryption, and banking security protocols to meet industry standards.

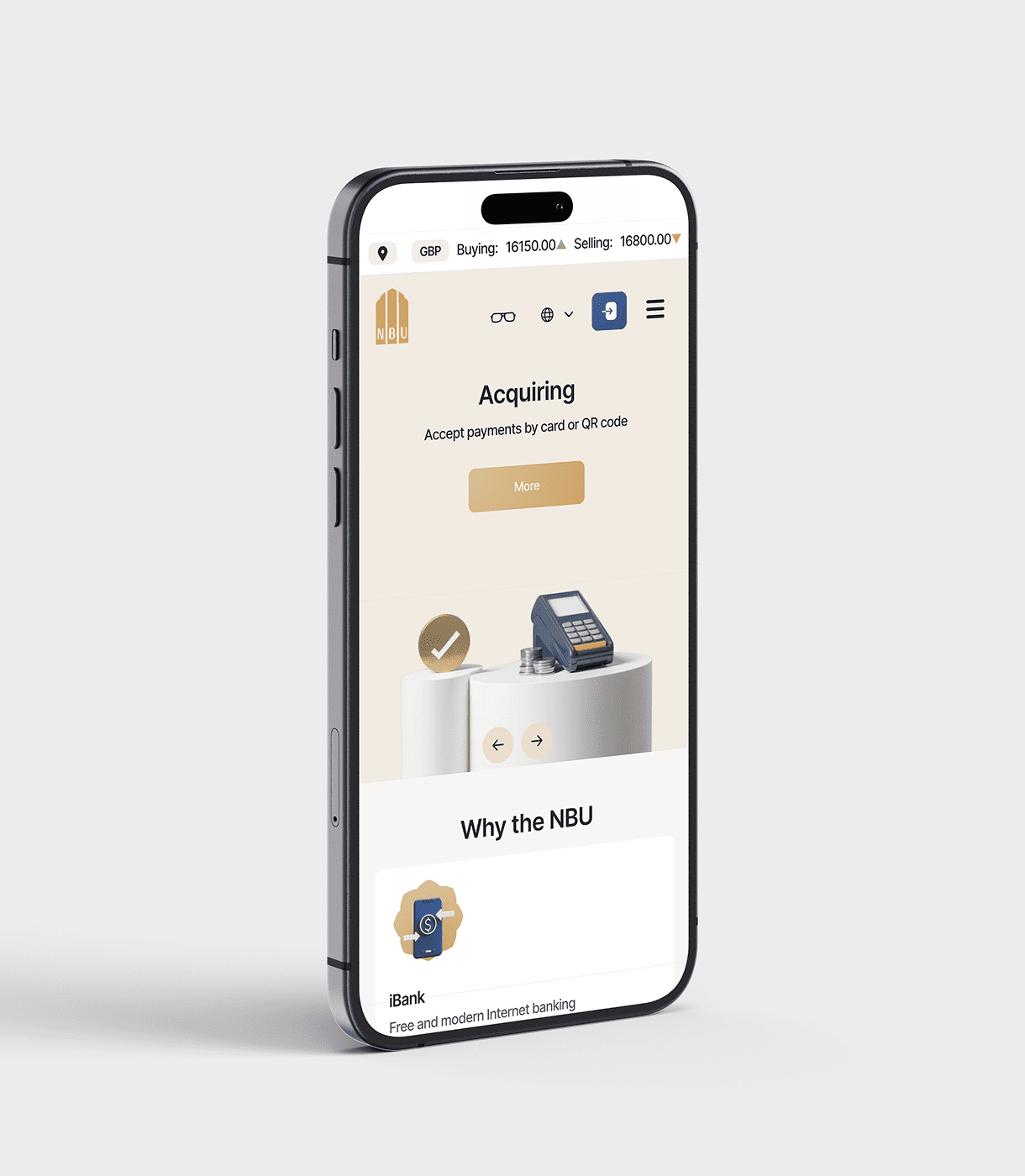

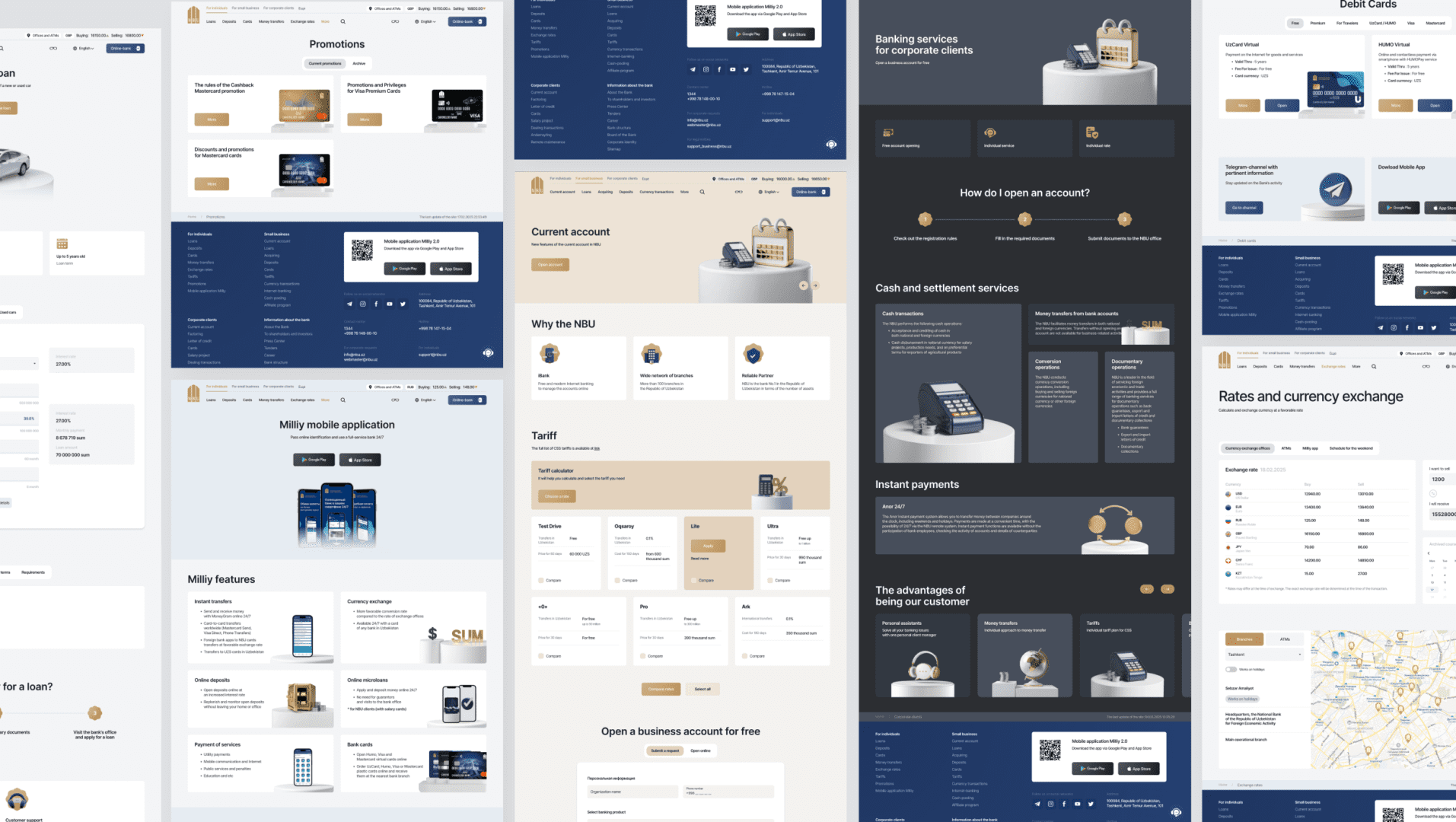

To enhance user experience and improve brand consistency, the platform features three dynamic color themes, designed to serve different customer segments:

- Main Theme – The standard theme representing the bank’s identity, used for general banking services.

- Corporate Theme – A professional theme tailored for corporate and enterprise clients.

- Small Business Theme – A visually distinct theme designed to better serve small and medium-sized businesses.

These color themes are dynamic, meaning that content administrators can choose and apply any of them when building pages through the website’s dashboard. This feature provides flexibility, allowing administrators to tailor the digital experience for different audiences while maintaining a cohesive design.

Services provided:

- UX/UI Design & Optimization: Conducted user research, wireframing, and usability testing to create a modern banking experience.

- Custom Web Development: Developed a secure, high-performance banking platform using Laravel and Statamic CMS.

- Performance Optimization for SEO: Improved page speed, caching, and image compression for higher search rankings and better user experience.

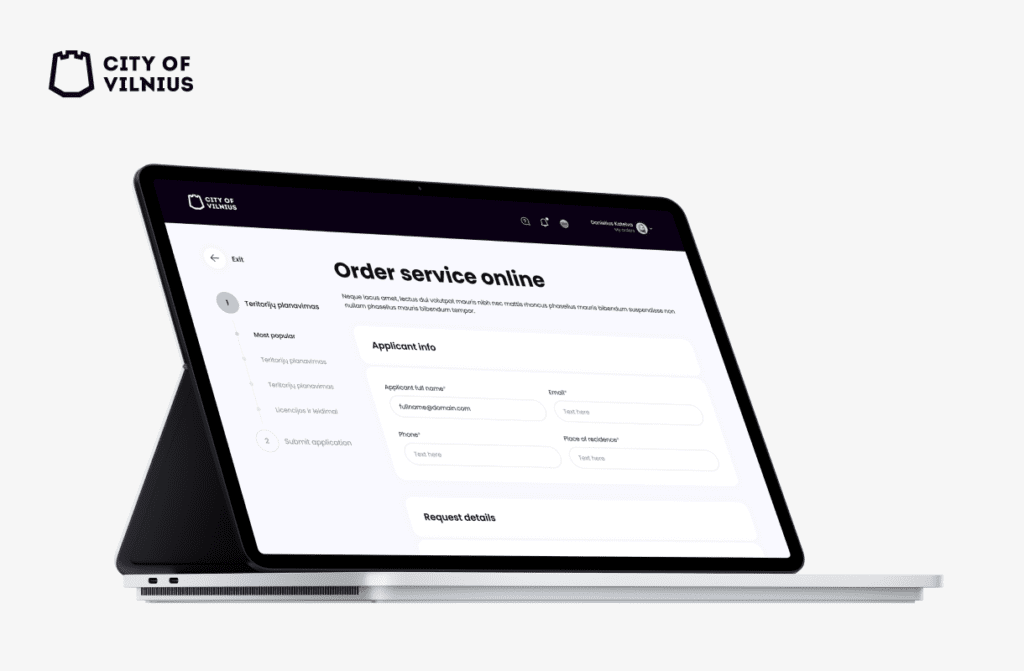

- Mobile Optimization: Designed a fully responsive digital banking platform for both desktop and mobile banking users.

- Banking API & Third-Party Integrations: Integrated loan calculators, financial tools, and HeadHunter API for automated recruitment management.

- Security & Compliance Solutions: Ensured adherence to banking security standards, implementing SSL encryption, OAuth 2.0 authentication, and real-time security monitoring.

Project result:

The new NBU Digital Platform successfully transformed the bank’s online presence, delivering measurable improvements in user experience, content management, and operational efficiency:

- 40% Faster Page Load Speeds: Improved website responsiveness, reducing bounce rates and improving SEO rankings.

- 60% Faster Content Updates: Enabled internal teams to update content without developer intervention, increasing efficiency.

- Enhanced User Engagement: The combination of intuitive design, simplified navigation, and self-service features has improved customer interactions with banking services.

- Positive Stakeholder Feedback: NBU’s internal teams have praised the ease of content management, while customers enjoy a seamless and responsive banking experience.

With Phase 2 Enhancements already in progress, Civitta continues to support NBU in expanding the platform’s capabilities, including customer form upgrades, CRM integration, and additional digital banking services.

This collaboration marks a significant milestone in NBU’s digital banking transformation, positioning it as a leader in modern, scalable, and customer-centric banking solutions.